T21-0198 - Distribution of Individual Income Tax on Long-Term Capital Gains and Qualified Dividends by Expanded Cash Income Level, 2018 | Tax Policy Center

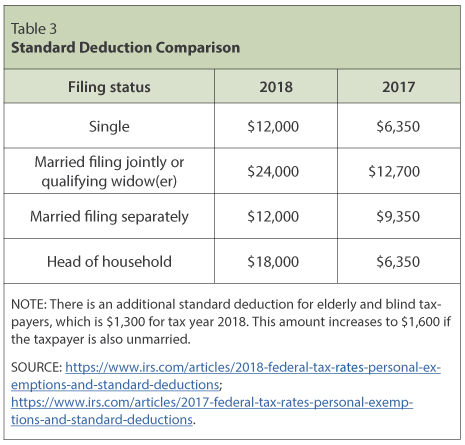

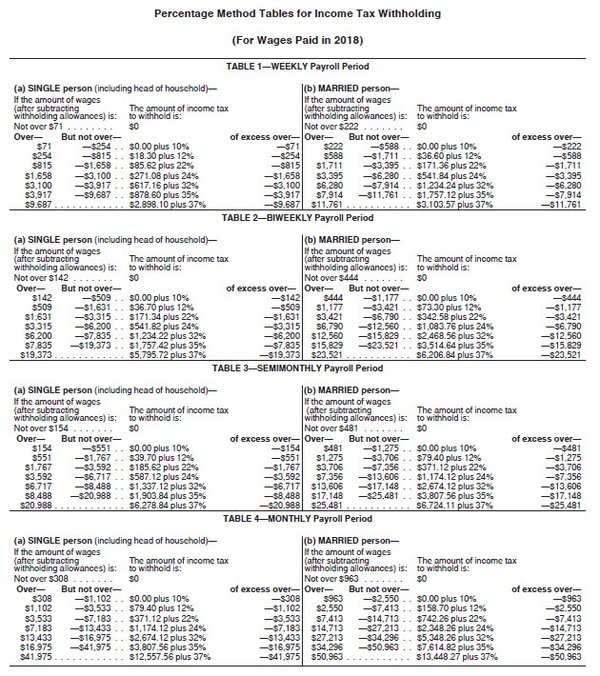

Payrole - Revised withholding tax table for compensation This Tax Alert is issued to inform all employers of the new withholding tax rates on compensation of employees effective January 1, 2018. The

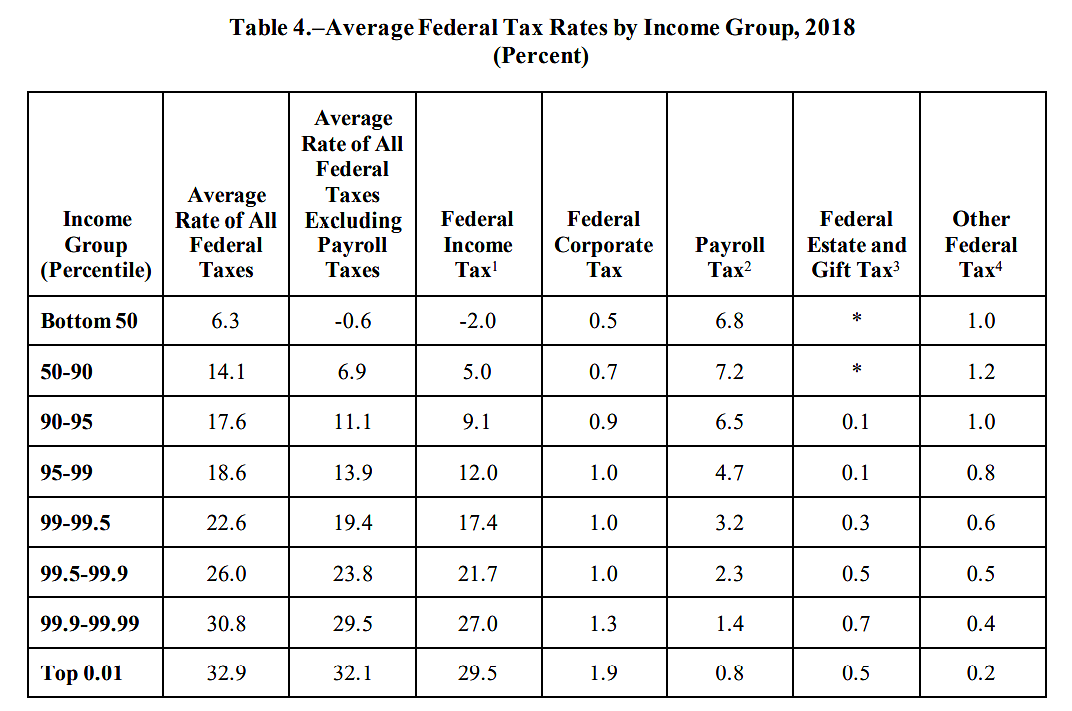

What Is the Average Federal Individual Income Tax Rate on the Wealthiest Americans? | CEA | The White House